Disability Insurance (Short & Long-Term)

Short-term Disability Insurance

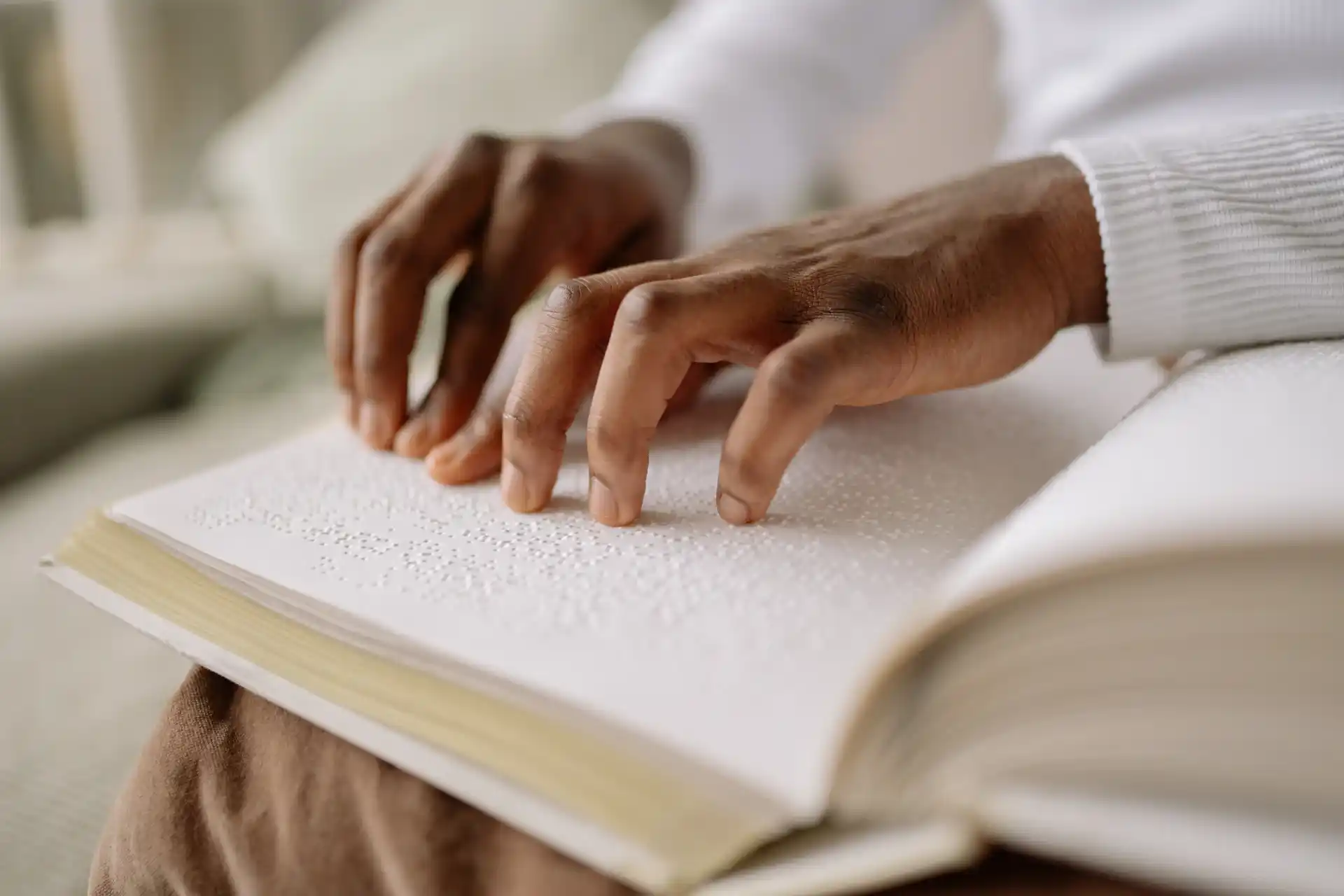

A sudden illness, injury, or medical procedure can take you away from work—but your bills won’t wait. Short-term disability insurance offers weekly income replacement to help cover expenses when you can’t work due to a non-work-related illness, surgery recovery, or off-the-job injury. It’s a practical way to maintain income security while focusing on your health. Whether you’re dealing with complications from pregnancy or recovering from outpatient surgery, this temporary disability coverage bridges the gap while you heal.

At CoverCare Insurance Inc., we understand the financial stress that time off work can cause. That’s why we help you compare flexible, affordable plans with benefits that typically last from a few weeks up to 12 months. Whether you’re self-employed, retired but still working part-time, or simply want paycheck protection beyond what your employer offers, we’ll guide you to disability benefits that fit your income, lifestyle, and peace of mind. You’ve worked hard—let us help you stay protected when life throws you off course.

Table of Content

Long-Term Disability Insurance

An illness or injury that takes you out of work for months—or even years—can put your finances at serious risk. Long-term disability insurance offers essential income protection by replacing a portion of your wages, typically 50% to 70%, when you’re unable to work due to a covered condition. After an elimination period, you begin receiving disability benefits that can last several years or even until retirement. At CoverCare Insurance Inc., we help you compare extended disability coverage options from leading carriers, tailored to your occupation, income, and goals. Gain financial security with coverage that supports your lifestyle and future—no matter what happens.

Disability Insurance (Short & Long-Term)

You can talk about Disability Insurance (Short & Long-Term) with the following representatives in any of our offices:

Related FAQs

What is Disability Insurance?

Disability insurance—also known as disability income insurance—provides a portion of your income if you’re unable to work due to illness or injury. It’s not tied to workplace accidents like workers’ compensation.

What’s the difference between short‑term and long‑term disability?

Short‑term disability (STD) covers temporary disabilities, usually paying for 3–12 months with elimination periods from 7–30 days. Long‑term disability (LTD) supports longer absences—2, 5, 10 years, or up to retirement—with elimination periods often around 90 days.

How much of my income do these STD/LTD policies replace?

STD typically covers 60–80% of pre-disability income. LTD generally pays 40–70%, depending on your policy.

What is an elimination period in Disability Insurance?

An elimination period is the waiting time before benefits start. It’s usually 7–30 days for STD and around 90 days for LTD.

Can I have both STF/LTD coverage?

Yes—and it’s often recommended. STD bridges short absences, while LTD supports longer-term disability. They often coordinate so STD benefits pay first, then LTD begins.

Who provides disability insurance?

STD is commonly offered as a group benefit through employers, while LTD may also be employer-sponsored—or bought individually by self-employed or unsponsored individuals.

Does STD/LTD cover mental health or pregnancy?

Yes—most STD and LTD plans include pregnancy recovery, mental health issues, elective surgeries, and common illnesses like cancer or heart conditions.

Can I receive both Social Security Disability and LTD?

LTD benefits may be offset by Social Security Disability Income (SSDI), depending on the policy. Employer group plans often coordinate with SSDI; individual plans might not.

How much does Disability Insurance cost?

Premiums generally run about 1–3% of annual income, similar for STD and LTD. Individual factors like age, health, and occupation can influence the rate.

Do I need both STD and LTD coverage?

If you don’t have savings to cover 3–6 months, STD is important. If long absences could threaten retirement or financial stability, LTD offers protection well into the future .